Dairy Queen Real Estate Investment

Dairy Queen Real Estate Investment

Single-Tenant NNN Free-standing Real Estate

FULLY FUNDED

Cash on Cash Grows to 6.62% in 2025

(paid monthly – does NOT include Sale proceeds)

Estimated

Properties Description

| Address: | 1409 W. Austin St. Port Lavaca, TX 77979 |

|---|---|

| Year Built/Renovated | 1970/2018 |

| Current Occupancy: | 100% |

| Net Rentable Area: | 2,040 square feet |

| Land Area | 1.08 Acres |

| Parking: | Ample with 100% Concrete Parking Lot |

Investment At A Glance

| Property Name | Dairy Queen 1409 W. Austin St. Port Lavaca, Texas |

|---|---|

| Property Cost: | $735,000 |

| Net Rentable Area: | 2,040 s/f |

| Investment Strategy: | Buy and Hold |

| Hold Period: | 5-8 years |

| Property Type : | Single Tenant |

| Distributions: | |

| Purchase Cap Rate: | 7.2% |

| Estimated Closing Date: | September 1, 2021 |

*see Financials page

- TripleNetZeroDebt.com LLC along with investors, plan to acquire a single-tenant free-standing industrial building located at 12468 Aetna St. Van Nuys, CA (the “Property”) that is 100% occupied. Investors are being provided the opportunity to become investors in the Property. The Management Company, JDS Real Estate Inc. (Manager) will handle all aspects of the investments including vetting and acquiring the Property, completing the acquisition, day-to-day operations of the Property and ultimately selling the Property.

- This acquisition is intended to be a “Buy and Hold” strategy. The hold period is intended to be 5 to 8 years, however it could be shorter or longer depending on market conditions as well as the desire of the investors. Investors have the opportunity to participate as investors in the Property and earn a portion of the cash flow and appreciation. Investors can expect to receive monthly distributions, with the first distribution projected on or before the 91st day following the escrow closing of the Properties.

- This Property represents a unique opportunity to invest in a stabilized, 100% occupied, freestanding, single-tenant, net-leased asset. The property has existing in-place cash flow and offer investors a stable monthly cash flow with the potential of asset appreciation through built-in contractual rental increases.

Investment Details

- Property: 100% occupied, single-tenant, net-leased, free-standing industrial building.

- National Tenant: The Property is 100% occupied.

- Built In Rental Increases: The Lease is an absolute triple net lease (NNN) with annual rental increases. TripleNetZeroDebt.com LLC may elect to form one or more LLC’s for the purchase. In the event this was to occur, investor would become members within one or more of the LLCs with TripleNetZeroDebt.com LLC being its Managing Member.

- TripleNetZeroDebt.com LLC may elect to form one or more LLC for the purchase. In the event this was to occur, investor would become members within one or more of the LLCs with TripleNetZeroDebt.com LLC being its Managing Member.

Investment Highlights

Risks and Risk Mitigation

- Forward-Looking Statements: Investors, Members and Co-owners should not rely on any forward-looking statements made regarding this opportunity because such statements are inherently uncertain and involve risks. We use words such as “anticipated,” “projected”, “forecasted”, “estimated”, “prospective”, “believes,” “expects,” ”plans” “future” “intends,”, “should,” “can”, “could”, “might”, “potential,” “continue,” “may,” “will,” “averages” and similar expressions to identify these forward-looking statements.

- Illiquid Investment - Transfer Restrictions & No Public Market: The transferability of either a Tenant-in-Common interest or a membership interest in the LLC (if one is formed) are restricted both by the operating agreement for that entity and by U.S. federal and state securities laws. In general, investors will not be able to sell or transfer their interests. There is also no public market for the investment interests and none is expected to be available in the future. Persons should not invest if they require any of their investment to be liquid. This is particularly important for persons of retirement age, who should plan carefully to assure that their assets last throughout retirement.

- Macro Retail Risk: The industrial asset class can be volatile, especially due to the industry the current tenant is a part of. This risk is partially mitigated by the fact that this property is 100% occupied by a Single Tenant Free Standing tenant.

- Tenant Accounts for 100% of Rental Revenues: The single tenant accounts for 100% of the revenues. The success of the property is thus tied to the ongoing lease with the Tenant. If Tenant defaulted on its lease or otherwise stopped paying rent, this would cause all distributions to cease until such time as a new tenant was found. Since the Property is being purchased all cash, there will be no debt to service.

- Leasing Risk: There is a risk that the leasing team will be unable to lease the space if it becomes vacant from time to time. This Property is currently 100% occupied and has also been historically well occupied despite difficult economic conditions.

- Management Risk: Investors will be relying solely on the manager of JDS Real Estate Inc. for the execution of its business plan. That manager in turn may rely on other key personnel with relevant experience and knowledge, including contractors and consultants. Members will agree to indemnify the Manager in certain circumstances, which may result in a financial burden if any litigation results from the execution of the business plan. While the Manager has significant operating experience, TripleNetZeroDebt.com was formed recently and has little significant operating history or record of performance.

- Principle of Manager Will Participate as an Investor: The Manager of JDS Real Estate Inc. will participate as an investor in the Property either directly or through an entity. Participation will include, but may not be limited to, the value of any excess distributable cash flow and or any appreciation of the property realized upon its sale. This could lead to a potential conflict of interest between the Manager and Investors/Members. Investors/Members must recognize and agree to waive and bear the risk of this conflict of interest. Additionally, the Manager of JDS Real Estate Inc. is an owner, investor and manager of the Licenses that are attached to this Property that allow the tenant to conduct its business. This additional investment demonstrates his commitment to this area and this property. Manager may now or in the future purchase and or participate in other property purchases and or Licenses in and around the vicinity of this property.

- Uncertain Distributions: The Manager, TripleNetZeroDebt.com or its officers or agents cannot offer any assurance that there will be sufficient cash available to make distributions to the Investors from either net cash from operations or proceeds from the sale of the asset. Manager, in its discretion, may retain any portion of such funds for property operations or capital improvements.

- Risk of Interest Charges or Dilution for Sponsor Capital Calls: : The amount of capital that may be required by the Property from its Investors, Co-owners is unknown, and although it is not required that its Investors or Co-owners contribute additional capital to the Property, it may from time to time request additional funds in the form of loans or additional capital. The Manager does not intend to participate in a capital call if one is requested by the Investors or Co-owners and in such event the Manager may accept additional contributions from Investors or Co-owners or borrow the funds, or admit new Investors or Co-owners contributing new cash to the Property. Amounts that the Manager and/or the contributing Investors or Co-owners advance on behalf of the Property may be deemed to be either loans to the Property, or else as additional capital contributions, in which case the non-contributing Investors or Co-owners interest in the Property will suffer a proportionate amount of dilution.

- General Economic and Market Risks: While TripleNetZeroDebt.com and the Manager have conducted significant research to justify the intended rental rates and sales price relative to comparable properties in the market, their best efforts to forecast economic conditions cannot state for certain whether or not investor sentiment and the capital markets will be favorable to the property at any intended disposition date. The real estate market is affected by many factors, such as general economic conditions, the availability of financing, interest rates and other factors, including supply and demand for real estate investments, all of which are beyond the control of TripleNetZeroDebt.com and the Manager of the Property.

- Cannabis Industry: Investors acknowledge that this Property and its tenant are currently operating in the legal cannabis business of distribution, manufacturing and cultivation of cannabis products. The Licenses in which allow them to operate legally are partially owned separately by the Manager and Manager may receive separate compensation from tenant for the use of such Licenses. This provides investors with an additional layer of risk mitigation in the event the current tenant was not to succeed.

*The above is not intended to be a full list or discussion of all the risks of this investment.

Jason Schwetz – CEO of JDS Real Estate Inc.

Mr. Schwetz has managed, leased, and financed over 1 million square feet of retail real estate and has financed over $100,000,000 worth of commercial real estate. As a member of the International Council of Shopping Centers for the past 28 years, Mr. Schwetz holds the highest designation of CRX, Certified Retail Property Executive as well as a CSM, Certified Shopping Center Manager. Additionally, he has been a licensed California Real Estate Broker since 1988.

JDS Real Estate Inc. leverages its extensive relationships with owners, lenders and listing brokers to access retail and single-tenant properties. Over 50% of previous deals and existing deals have been acquired through off-market or limited market processes.

Jason Schwetz is also the Founder, CEO and President of JDS Restaurant Group Inc. For over 24 years, JDS Restaurant Group Inc. has owned and operated Senor Grandes Fresh Mexican Grill located in Woodland Hills, CA. JDS Restaurant Group, created, built and operated 4 quick-service restaurants. Three of the four restaurants were sold between 1995 and 1997. The Woodland Hills location continues to serve delicious, fresh Mexican food.

When Jason is not working (which is rare) he is an avid hockey player, fan and coach.

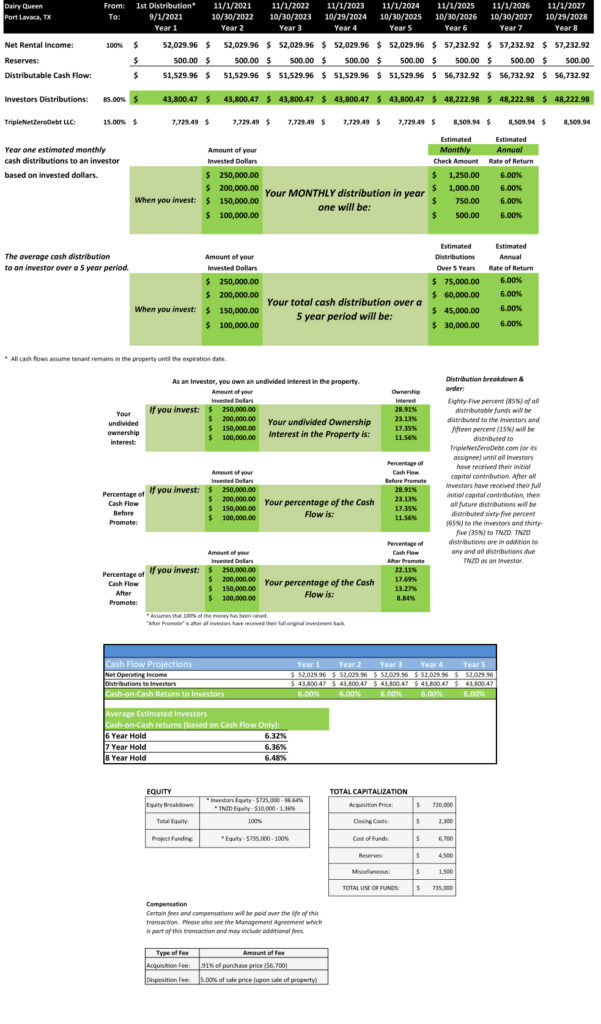

Note: The financials below assume TripleNetZeroDebt.com invests the full amount of the funds needed to close this transaction.

Distributions

Investors will earn monthly distributions equal to the rate in the Year One Estimated Monthly Cash Distributions To An Investor Based On Invested Dollars chart above. Provided no additional reserves are needed, distributions will increase in accordance with rental schedule as per the lease agreement.

All operational expenses and reserves of the Property will be deducted from the Gross Income first, prior to any distributions. Examples of deductions include but are not limited to: filing fees, accounting fees, tax returns, K1s (if any), legal fees, and reserves. Because any and all fees are not known at this time, Investors distributions stated above are reasonable estimates.

Distributions will commence on the 61st day following the closing. The first two months of rental income may be held in reserves, and if so, will be added to the Property's reserves if deemed needed.

The above distributions does not include any distributions (if any) that will result from the sale of the Property. Any distributions made as a result of Sale Proceeds (if any), will be in addition to the above cash on cash returns.

All distributions are at the discretion of TripleNetZeroDebt.com and its Managing Member who may need to delay distributions for any reason, including but not limited to: maintenance, repairs, replacements or capital reserves. All distributions are contingent upon the tenant paying its rent and CAMs in a timely manner and/or exercising its Option(s).

This page list some frequently asked questions that pertain to this specific Property. Please feel free to submit your own questions by emailing them to: info@TripleNetZeroDebt.com

Why don’t you give an IRR or an estimated IRR?

- In order to establish an IRR (Internal Rate of Return) the asset must be fully completed and sold. IRR takes into account the sale proceeds of an asset. We choose not to do an “estimated IRR” due to the fact that we do not believe we are psychics who possess the ability to predict the future. An “estimated IRR” would require us to pick an unknown point in time in the future as well as predict the sale price of the property. Since property “values” are influenced by many factors such as capital markets, supply and demand, occupancies, cap rates, etc., predicting a “time in the future” and a “future market value” is something we feel could be too misleading. While other investment companies choose to offer an “estimated IRR,” we choose not to try to predict the future. As Niels Bohr, the Danish physicist and winner of the Nobel Prize in Physics in 1922 would always say, “Prediction is very difficult, especially if it’s about the future.”

- Our investment properties cater to conservative accredited investors looking to a good rate of return with the lowest amount of risk. We feel that having no debt on the property achieves one of the most important components of “low risk.” Without debt there is no chance of a lender foreclosure. If the tenant was to vacate for any reason, having no debt on the property affords us the luxury of having no debt to service during any cash flow interruptions.

-

This is a common question asked, or at least it’s on the minds of investors and buyers. The answer to this question is simply, it does not matter. What does matter is that a sufficient amount of due diligence has been done on the property. If sufficient due diligence has been done on the property and the financial benefits are acceptable to the buyer/investor, then “why the seller is selling” (absent any fraud) should not matter to the buyer/investor.

Owners of properties sell for any number of reasons. Why a Seller is selling is not the question, the question should be “Why is the buyer buying?” If you are satisfied with the due diligence and the financial benefits are acceptable, then the buyer should buy and the investor should invest.